The trucking industry is under attack by many states. The states continue to promulgate business tax regulations that are notoriously confusing and inconsistent for the transportation industry. Trucking companies are losing profits by not staying current with the diverse and constantly changing sales and use tax regulations. The recent economic climate, as well as the number of states operating at record deficits, means states are increasing efforts to bring in much needed revenue. Most states have a three to four year statute, so if you do not act proactively, with every passing month your company is losing profits forever.

National Fleet Services' objective is to identify, document and recover prior payments of sales and use tax which qualify for exemption under a state's law.

National Fleet Services' review is independent and free from conflicts. Our team of transportation specialists will perform a free external review of your accounts payable (purchasing) records without interruption and without disturbing existing business relationships. Our review generally covers a four-year period based on the state's statutory recovery period.

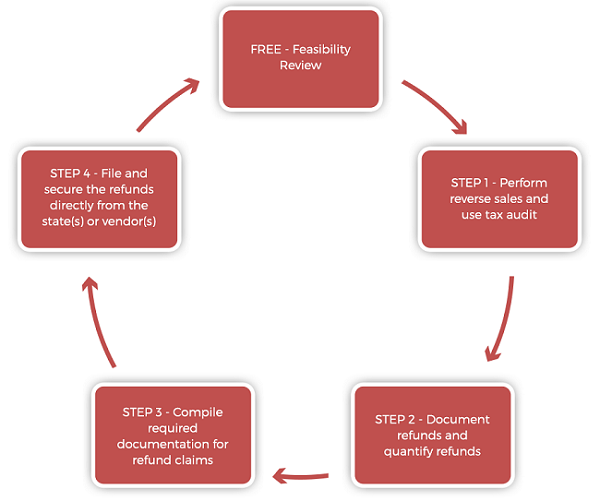

Our program is a four step process:

These services involve the identification and recovery of overpaid sales and use taxes on goods or services that are exempt from sales/use tax or are non-taxable. These over-payments arise from taxes paid to vendors or taxes accrued and paid directly to the state. To ensure that you benefit from future tax savings, National Fleet Services provides tax consulting services to minimize future tax exposures by creating and implementing best practices.